What Is a Budget Contingency?

A budget contingency in project management is a dollar amount that is budgeted to cover unforeseen expenses or risks that may arise during the course of a project. These funds act as a buffer to ensure the project team can adapt to unexpected changes without exceeding the overall budget.

In a conference paper for PMI, authors Kenric England and John Moreci conducted a comprehensive analysis of contingency management, focusing on how to estimate, justify, and manage contingency reserves. They define contingency as “an amount of funds added to the base cost estimate to cover estimate uncertainty and risk exposure.”

Contingency budgets are important to help mitigate risks associated with overspending due to factors such as scope changes, supply-side issues, and more. The following image shows how a project’s contingency budget might relate to a company’s broader budget:

Two other important concepts in contingency planning are project contingency and financial contingency. Project contingency refers to funds set aside to cover unexpected costs or risks specific to a project’s execution, such as delays or changes in scope. Financial contingency is a broader reserve allocated to handle unforeseen financial challenges. Both are crucial components of contingency budgeting to ensure overall cost control and flexibility.

Project management that adapts to your needs

Work with flexibility and security—from small projects to large-scale processes and entire portfolios.

Smartsheet empowers teams to manage projects of any size by breaking them down into tasks, tracking dependencies, and visualizing progress. With tools for resource management, budget tracking, and workflow automation, you can ensure efficient project delivery.

The platform also provides real-time dashboards and reporting for better decision-making, helping you scale projects into programs seamlessly. Collaborate with your team on one unified platform to plan, manage, and execute projects successfully.

Budget Contingency Factors

Many factors contribute to the need for a budget contingency. Some common examples are poor risk assessment, scope creep, repairs and maintenance, project timeline changes, supply chain issues, poor project management, faulty equipment, unplanned emergencies, and more.

Here are the most common factors in budget contingency:

- Changes to Owners or Stakeholders: When owners or stakeholders change, the project’s requirements often do too. This can lead to unplanned costs that a contingency budget can cover.

- Scope Creep: Scope creep is a common culprit for increased financial costs. As the requirements for a project grow, so do the costs — thus, it’s a good idea to allocate contingency funds at the beginning of a project. Check out our collection of project cost templates to help you estimate increasing costs as your project scope expands.

- Poor Project Management: Projects that are poorly managed often cost more than those that aren’t. Without an accurate assessment of a project’s timeline and budget at the beginning and at critical points during its duration, it is difficult to control costs. If you are new to managing projects or are not confident in your tools, factor in extra budget from the start to avoid costly overruns.

- Unrealistic Risk Assessment: Project managers should assess risks early on to help mitigate potential disasters. Unmanaged risks can delay, derail, or end a project completely, which can be very costly. Consider using one of these contingency plan templates to help you identify and prepare for risks.

- Project Timeline Changes: The longer a project takes to close, the more it costs. Include extra funds in your contingency budget in case deliverables are delayed and the timeline is extended.

- Industry-Specific Needs: Know the needs of your industry. Ensure that you have all of the necessary permits and meet governance requirements before you begin. Otherwise, have a plan in place to secure them as needed so you do not run into unexpected fines or penalties later.

- Supply Chain Issues: Sometimes the need for a budget contingency arises from factors beyond your control. Supply chain issues can affect the materials you can use or the timelines you can receive them, which can in turn increase project costs.

- Labor Changes and Requirements: Ensure that you account for the labor you will need at all stages of the project. Your contingency budget should reflect the possibility of increased labor costs.

- Unplanned Events and Emergencies: From natural disasters to widespread illnesses on your staff, there is no way to predict every emergency. Build a little extra into your budget to cover unplanned events and emergencies that may arise.

- Equipment Repairs and Maintenance: Even with regular maintenance, equipment can break down. Ensure that you have enough in the budget to cover unexpected maintenance or equipment replacement.

How to Calculate the Contingency Budget

Typically, a contingency budget is based on the project's total estimated budget, plus its complexity, uncertainty, and the historical data of similar projects. Contingency budget calculations can be either deterministic, meaning they rely on fixed values and assumptions without considering variability, or probabilistic, meaning that the method accounts for random chance.

Before you can calculate your contingency budget, you need to calculate your initial project budget. This budget should include everything you need to complete the project, including fixed costs, material costs, and labor costs. One of the easiest ways to do this is by using one of these project budget templates. Next, you will need to decide which method you will use to calculate your contingency budget.

“Some industries have their own standards for doing what’s called parametric estimates, where they assign dollar amounts to known metrics. For example, construction projects might relate dollars to each square foot, and programming projects might equate dollars to lines of code,” explains Bryan Berthot, Scrum Master, Project Manager, and doctoral candidate at the University of South Florida. “Another type of contingency budgeting is creating a company reserve. If an unanticipated event occurs that blocks or delays a project, management may authorize additional funds from that company reserve to keep the project going.”

Most companies will choose to create a contingency budget for individual projects instead of or in addition to a company reserve. This article will focus on the most common methods of calculating a project-based contingency budget: by percentage, by potential risks, and with advanced scenario analysis.

When to Use Probabilistic vs. Deterministic Budget Calculation Methods

Use deterministic contingency budgeting when project variables are well-defined and stable, and there is minimal uncertainty; this makes it easier to use fixed estimates. Probabilistic budgeting is better for complex projects with high levels of uncertainty and risk, as it accounts for varying outcomes and probabilities.

Probabilistic methods include probability trees, parametric modeling, range estimating, the analytical hierarchy process, the Monte Carlo Simulation, and others. Deterministic methods include fixed cost estimates, expert judgment, historical data analysis, and standard percentage-based contingencies.

Sidharth Ramsinghaney, Director of Strategy and Operations at Twilio, suggests that the decision between using deterministic or probabilistic methods largely depends on the nature of the project. “In essence, the choice between deterministic and probabilistic methods depends on the project’s scope, complexity, and available resources,” he says. “Deterministic methods are more suitable for well-defined projects with limited resources, while probabilistic methods are ideal for complex projects with a level of uncertainty or critical stakes.”

Here is how Ramsinghaney outlines the conditions that are best for probabilistic and deterministic methods:

Deterministic Methods

- Well-Defined Scope and Risks: For projects with repetitive tasks and minimal unknowns, deterministic methods work well. “For example, during recurring quarterly projects, we use a flat percentage for the contingency budget. The process is well-established, and risks are well-understood, allowing for efficient resource allocation,” says Ramsinghaney.

- Limited Resources and Time: Deterministic methods are often faster to use, which can be important when time and resources are short. “In a recent product launch, we faced tight deadlines and resource constraints. A deterministic approach enabled quick contingency budgeting, ensuring the launch proceeded without delays,” explains Ramsinghaney.

Probabilistic Methods

- High Uncertainty and Complexity: Probabilistic methods account for random chance, which is important when a project has a high level of uncertainty. “At McKinsey & Company, I led a business transformation project with significant market uncertainties. Scenario analysis helped us model various outcomes and allocate a more accurate contingency budget,” says Ramsinghaney.

- Critical Projects With High Stakes: When the stakes are high, it is more important than ever to ensure a high degree of accuracy when calculating a contingency budget. “During one of the acquisitions at Twilio, I used risk analysis to quantify potential integration risks. This approach ensured a robust contingency budget aligned with the project’s risk profile,” explains Ramsinghaney.

Budget Contingency Calculation Methods Breakdown

Below are three of the most effective and accessible methods to calculate a contingency budget and when to use each. We’ll explain in detail how to perform each calculation in the sections below.

Budget Contingency Calculation Method | When to Use |

|---|---|

| Percent of Project Base Cost Estimate | Use for simple, lower-budget projects, or where costs are fixed or very predictable. |

| Risk Probabilities and Potential Financial Impact | Use for more expensive, complicated projects where there are many potential risks or numerous moving parts. |

| Advanced Scenario Analysis | Use for projects that you have completed successfully in the past, have documented well, and can therefore accurately predict the kinds of scenarios you will encounter. |

“For my company, we calculate our contingency budget using a risk assessment model based on the potential financial consequences of identified risks. This lets us more effectively allocate our funds by rating high-risk situations above low-risk ones, thereby using resources to reflect our individual needs and priorities,” explains Matt Grammer, CEO and Founder of Counseling Now.

Percent of Project Base Cost Estimate

For most industries, the most common method of determining a contingency budget is using a flat percentage of the total estimated project cost. Depending on the type of project and industry you’re in, a percentage-based contingency may be anywhere from 5 to 15 percent of the estimated total cost of the project.

“To calculate a contingency budget by percentage of base cost, augment the project budget by a straight percentage based on the data from previous similar projects you’ve completed (e.g., $400,000 base cost + 15 percent),” explains Berthot.

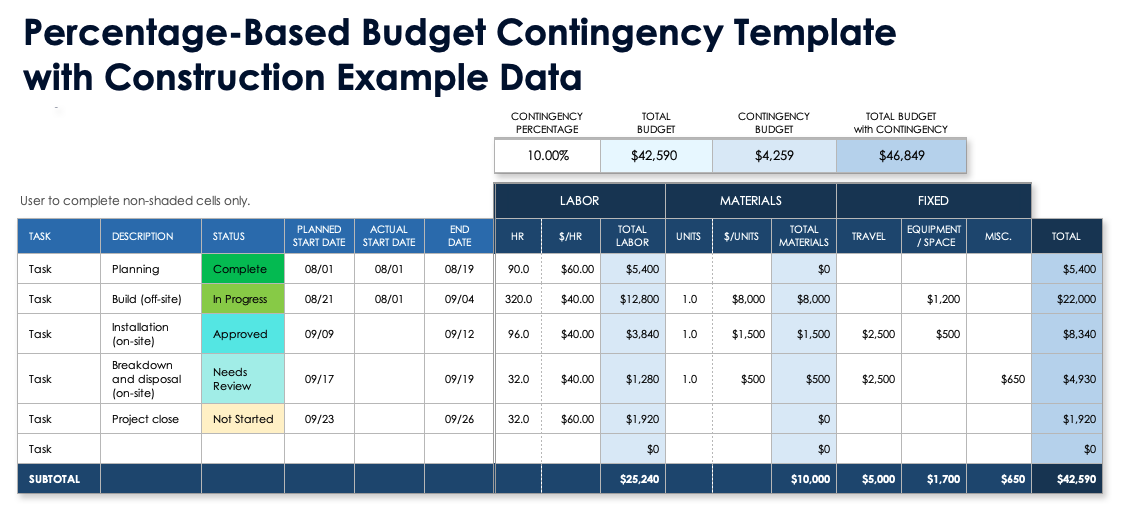

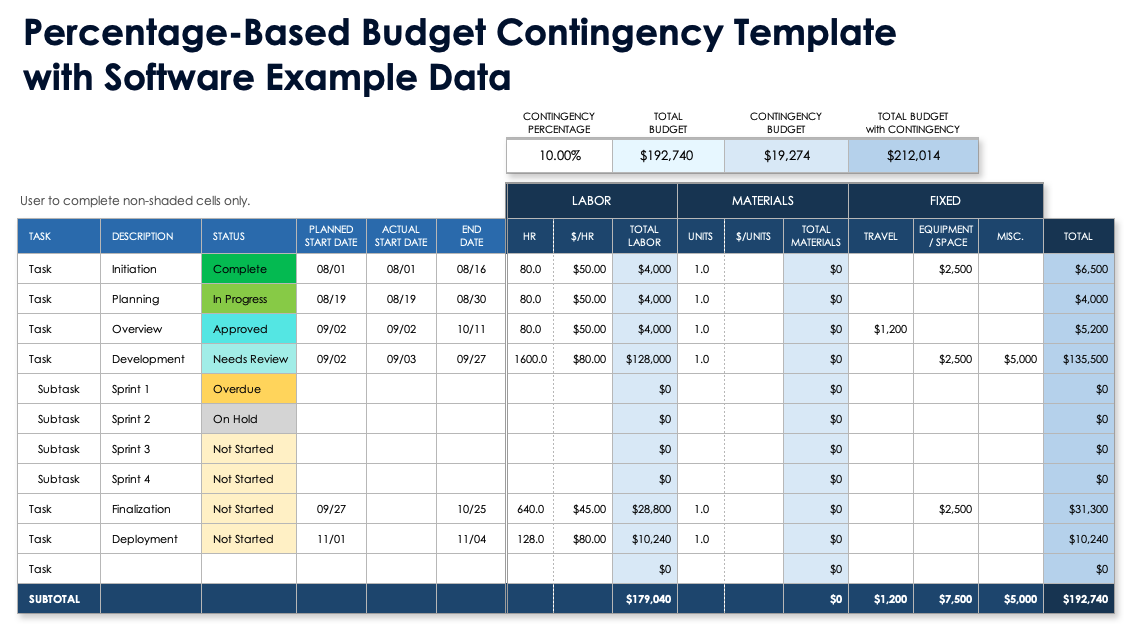

Here are the steps for calculating the percentage of project base cost estimate:

- Download the percentage-based budget contingency template .

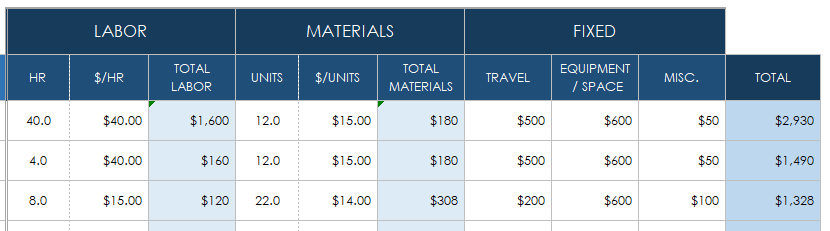

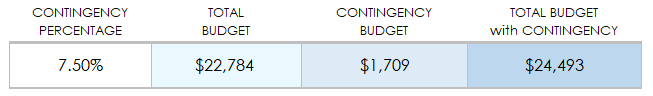

- Enter the units and costs for your labor, materials, and fixed costs for each project task. The template will automatically calculate the total estimated budget for each task at the end of the row.

- When you have entered all of your information, enter the desired percentage value for your contingency budget. The template will automatically calculate the project budget, the contingency budget, and the total budget with contingency based on the data you entered.

Depending on the type of project and your industry, the percentage value you use may differ. Most construction projects, for example, use a number close to 15 percent to account for the variable costs of labor and materials. whereas a software development project may use a number closer to 5 percent since labor and material costs are more fixed.

Risk Probabilities and Potential Financial Impact

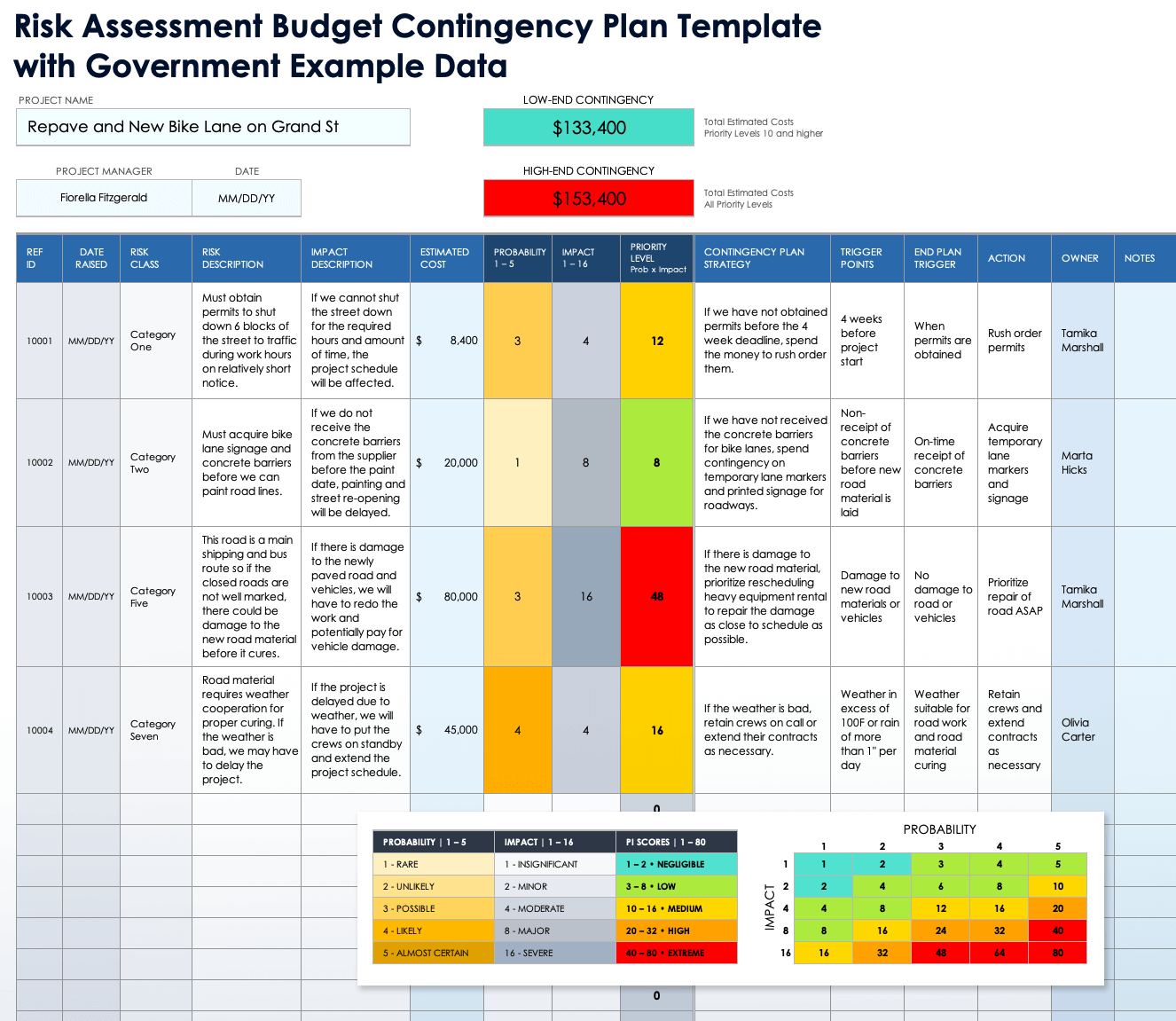

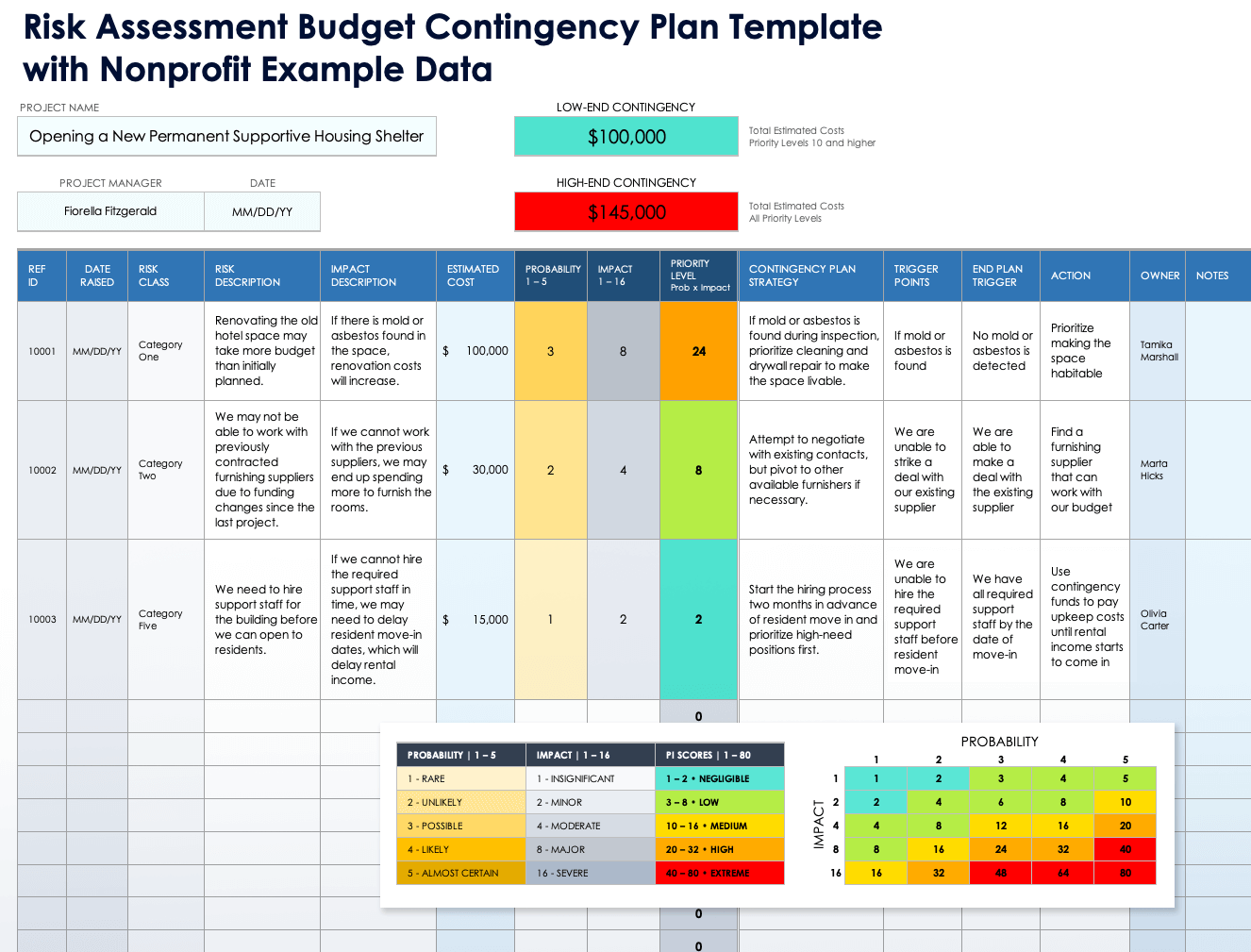

You can calculate a contingency budget by identifying project risks, estimating their potential impacts, and assigning probabilities and dollar amounts to each. Multiply impact by probability to find the priority level, then sum their estimated costs based on your level of risk tolerance.

Using our risk assessment budget contingency plan template makes it easy. Download the template for free and find step-by-step instructions in the how-to section of this article.

To discover more ways to identify and calculate risks, check out our collection of free risk register templates.

Advanced Scenario Analysis

Advanced scenario analysis involves identifying all scenarios that could be the result of an event and all possible outcomes. Compare what is certain to what is uncertain, and make decisions based on what you expect to happen.

It is possible that some scenarios may not lend themselves to needing a contingency budget at all. “For projects that are routine and well-trodden, with minimal variability — such as standard upgrades or deployments that a company has executed repeatedly — a contingency budget might be unnecessary and could foster a less disciplined approach to resource management,” says Ramsinghaney.

For most scenarios, however, a contingency budget could save you from serious headaches down the road. “In projects characterized by high variability, significant change, cross-functional dependencies, external influences, or those critical to business continuity, a well-structured contingency budget becomes essential,” says Ramsinghaney. “Such projects might include launching a new product line, entering an untested market, or implementing a novel technology. Here, contingencies should be thoughtfully planned with clear guidelines on when to utilize these funds, how much to allocate, and who has the authority to approve their use.”

The key is to find a balance between careful forethought and spending too much. A contingency budget shouldn't be an unlimited fund, but rather a planned reserve used only when needed and with consideration for the project's long-term benefits and sustainability.

Ultimately, deciding to include a contingency budget should be based on a thorough scenario assessment and an understanding of the project's specific challenges and opportunities. Use our collection of scenario analysis templates to ensure you’ve covered all your bases.

Other Determination Methods

Apart from percent of project base cost, risk probabilities, and advanced scenario analysis, there are many methods to calculate a contingency budget. Examples include probability trees, parametric modeling, range estimating, analytical hierarchy process, and Monte Carlo simulations. Some require specialized software to use.

Here is a list of other methods used to calculate a contingency budget:

- Analytical Hierarchy Process: The analytical hierarchy process (AHP) is a scoring model that uses pairwise comparisons to rank risks directly against one another. Teams can use this method to help prioritize risks by tolerance and determine a contingency budget based on the level of acceptable risk determined by the group. In a 2023 article, “Appropriate budget contingency determination for construction projects: State-of-the-art,” researchers determined that using AHP can help project managers model, analyze, and control the impact of risks, helping them make informed decisions, such as planning effective mitigation actions and re-assigning risk ownership. To learn more about other scoring models, see this article on scoring models in project management.

- Monte Carlo Simulation: “Another common practice is to perform a statistical modeling technique called a Monte Carlo analysis, which simulates total cost overruns if a project is run a fixed number of times, and then calculate a contingency based on the average percentage it runs over,” says Berthot. Monte Carlo simulations predict the probability of various outcomes when some information is unpredictable or random. This simulation requires specialized software to run and is often only used for large, expensive projects with large data sets. In his 2011 conference paper, “Monte Carlo simulation in cost estimating,” author Anthony Barreras explains how this method provides a clear basis for project contingency and management reserves and allows for cost justification of risk treatments.

- Parametric Modeling: Parametric models define explicit causal relationships based on historical project and resource data to estimate the cost, time, and resources required for future projects. This method requires software to perform complex regression analysis and to identify relationships between variables. According to the 2009 “Program Risk Contingency Budget Planning” study for IEEE Transactions on Engineering Management, parametric modeling can enhance accuracy in estimating contingency budgets by pooling risks and making regular updates and adjustments. Use this method for projects with a very low degree of uncertainty or variability.

- Probability Tree: A probability tree is a way to visualize possible outcomes for a project or task, as well as the probability and cost of each outcome. This clear visualization can help teams make better decisions regarding the contingency budget.

- Range Estimating: In range estimations, teams assign a range to the costs of potential risks, rather than a fixed value. This provides a minimum and maximum estimation for a contingency budget by summing the high-end and low-end ranges.

What Is a Budget Contingency Plan?

A budget contingency plan is a specialized section or offshoot of a risk management plan that includes a clear, actionable backup plan for the budget if things go off the rails. It should include the amount budgeted for the contingency, the types of risk events that would trigger its use, and the potential costs if those risks were to occur.

“Include both predictable and unpredictable uncertainties in your risk management plan,” advises Grammer. “Always expect the worst possible scenario, as it will provide you with the necessary data for managing your project’s unique hazards.”

Why Do You Need a Budget Contingency Plan?

All businesses need a budget contingency plan to handle unexpected expenses and to minimize financial risks. A plan helps to ensure that your projects are completed on time and within budget, and that your project teams are protected from undue stress.

A contingency plan can also lead to faster recovery times from roadblocks and a decreased chance of total project failure. When you have a plan in place to address issues, you can put that plan into action as soon as a critical issue occurs instead of panicking and acting in the moment. “During a sudden regulatory change, our contingency fund paid for extra compliance costs preventing service interruptions,” says Grammer. “If we had lacked it, we would have suffered major operational drawbacks that would have affected patient care.”

“A contingency budget is about being prepared for the unexpected, while also fostering a culture of accountability and efficiency,” says Ramsinghaney. If your team knows there is a plan in place, they are less likely to hide errors and risks that occur because there is already an established way to mitigate them.

It’s also important to note that a contingency budget is just that: a contingency. If the money isn’t spent, it’s just more money saved for the next project. “A contingency reserve may be added to the project budget to fund anticipated risks,” says Berthot. “If the risks don’t occur, then the money isn’t spent.”

Learn more contingency plans and review helpful examples in these articles on the essentials of contingency planning for project managers and on mastering contingency plans.

How to Create a Budget Contingency Plan

To create a budget contingency plan, first assess project risks. Then, quantify their financial impact and prioritize them based on expected costs. Next, calculate the contingency reserve based on your preferred method, and regularly review the budget to address emerging risks.

We’ll outline how to create a budget contingency plan using a template in the steps below.

- Download a Template

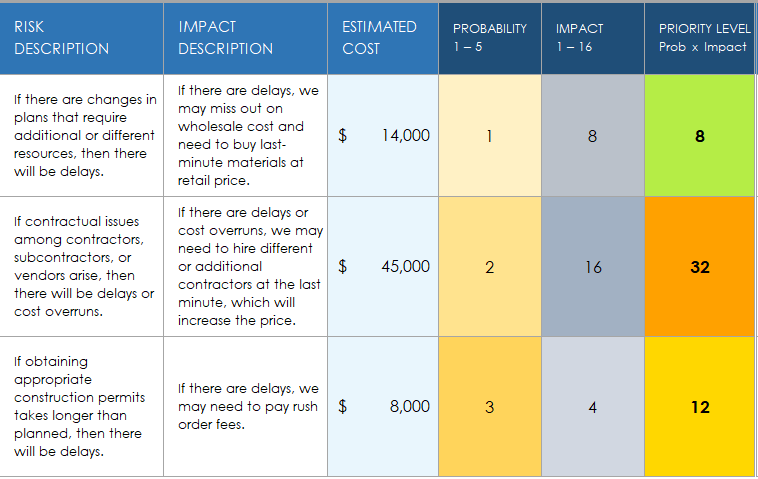

Select and download a risk assessment budget contingency plan . - Identify Risks

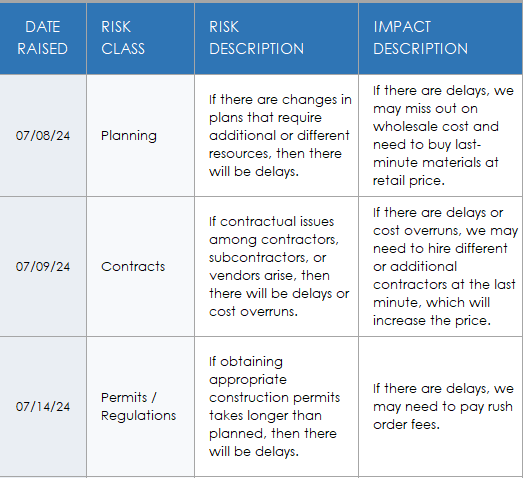

Identify risks that could impact the project, considering all project phases. Be realistic. Use past projects to help predict what could go wrong on future ones. - Enter Risk Information Into the Template

Fill in the Date Raised and Risk Class sections of your template. Then, enter the risk information and what the impact of those risks might be in the Risk Description and Impact Description sections.

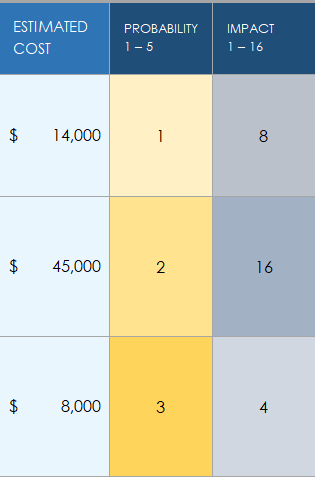

- Assess Impact and Probability

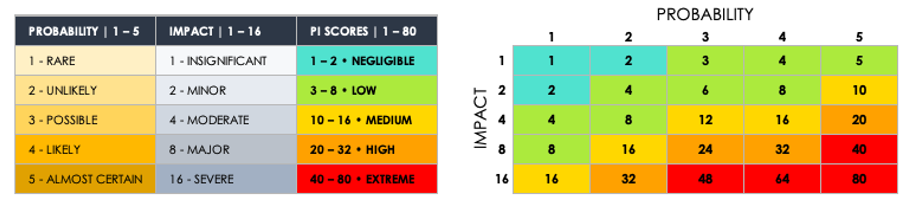

Evaluate the impact of each risk and the likelihood of its occurrence. Assign a realistic dollar value to the cost of the risk if it were to occur, and enter it into the Estimated Cost column. In the Probability and Impact columns, assign a numerical score based on how likely the risk is to occur and the severity of the risk if it does happen.

- Quantify Risks

Estimate the financial impact for each risk by multiplying its probability by its impact to get the priority level. This template will calculate this value automatically and color-code the corresponding cell to match the priority level key at the top of the template.

- Prioritize Risks

Rank risks based on their expected priority level to focus on the most significant ones.

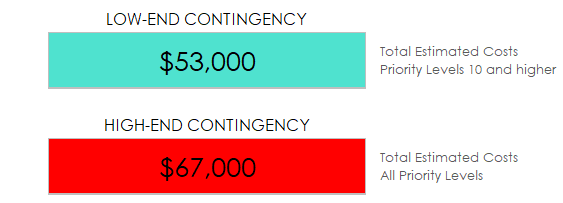

- Calculate Contingency Reserve

Sum the expected costs of prioritized risks to determine the total contingency budget. Use your prioritization system to determine both a high-end and low-end contingency value. This template calculates the low-end contingency value by summing the value of all risks with a priority level of 10 or higher, and the high-end contingency value by summing the value of risks at all priority levels.

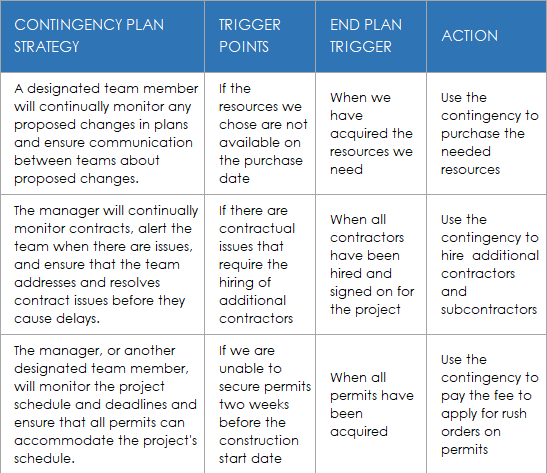

- Outline a Contingency Plan Strategy

Fill in the Contingency Plan Strategy column with the actions you will take to monitor and mitigate each risk. Use the Trigger Points, End Plan Trigger, and Action columns to outline, respectively, the specific triggers that will activate the contingency budget for each risk, what will end it, and what action you will take when the risk is triggered.

- Review and Adjust

Regularly review and adjust the contingency budget as new risks emerge, if possible.

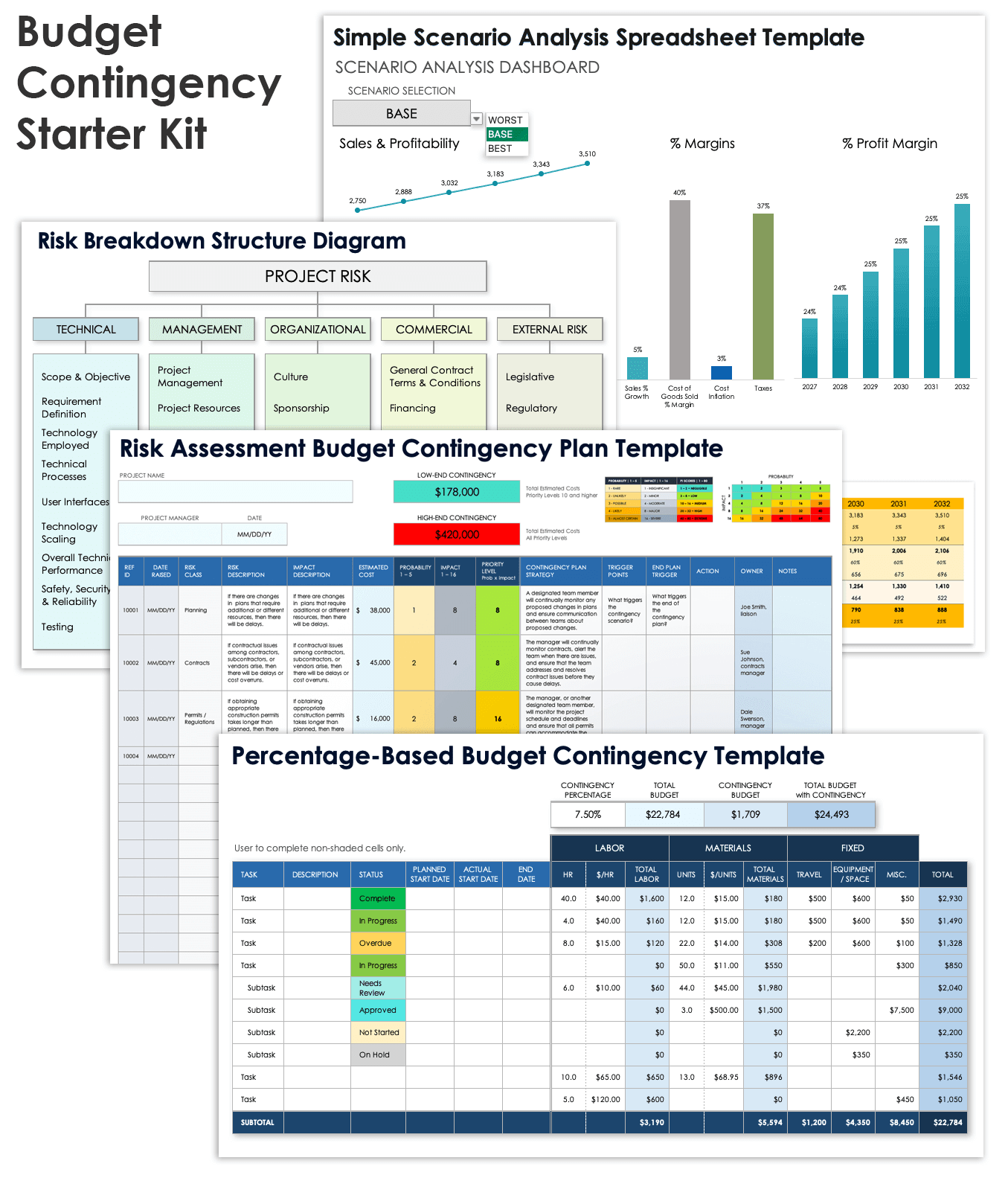

Budget Contingency Starter Kit

Download the Budget Contingency Starter Kit

We’ve created a free, downloadable budget contingency starter kit to help you create the contingency budget for your next project. This kit includes four, fully customizable templates for Microsoft Word and Excel to help you identify potential risks and calculate the contingency budget based on the three main methods outlined in this article.

This starter kit includes:

- A risk breakdown structure diagram for Microsoft Word to help you identify the types of risks that may exist in each project phase.

- A risk assessment budget contingency plan for Excel with a built-in risk register to help you organize, address, and prioritize risks based on their potential costs, as well as calculate a low-end and high-end budget contingency.

- A percentage-based budget contingency template for Excel to help you calculate a contingency budget based on a percentage of your total project budget.

- A scenario analysis template for Excel to help you calculate a contingency budget based on advanced scenario analysis.

Effectively Plan for Every Budget Contingency With Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change. The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed. When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.