What Is a Small Business Budget?

A small business budget is a detailed outline of your financial status and projection, based on your historical financial data. It includes your projected income and expenses and is used to determine where your money is best spent.

Ahmet Yüzbaşıoğlu, the Co-Founder of Peak Plans, explains the importance of budgeting for small businesses: “The success of your business is determined by the quality of your decisions. If you want to make informed decisions, you must have a budget. A budget can help you create a plan for the future, whether it's for your company as a whole or for smaller departments. More importantly, [a budget] gives you guidelines with which to make decisions. If budgeting is not yet a part of your business strategy, it may be worth considering it as an option to provide you with insights that can help you to better plan for all aspects of your company.”

Do Small Businesses Need a Budget?

All businesses should have a budget, especially small ones with less room for errors. A small business can better weather periods of low income by knowing exactly where its money is going, forecasting sales, and identifying what can be cut when needed.

Stephen Light, the Co-Owner of Nolah Mattress, gives his take on why all small businesses should have a budget in place: “For small businesses, creating an effective budget is one of the most important tools to carve a successful path to profitability. Budgets are crucial for allocating funds efficiently and curbing any unnecessary or wasteful spending, [which is] an easy trap to fall into if you don’t have a framework or goalposts to stay within. Budgets are especially important to small business owners who might be using their personal funds.”

How Much Should a Small Business Budget Be?

Your budget should be based on historical financial data and not exceed what you expect to make in the budgeted period. Be realistic with your numbers and projections so that you do not find yourself in a position you cannot recover from.

Your budget should take into account all of your sources of revenue and all of your expenses, as well as an additional percentage for any emergencies or surprises.

“Small businesses should absolutely be sure to pad their budget with contingency funds for unseen expenses,” suggests Light.

Larger businesses tend to make budgets annually, but for a small business, especially at first, it is a good idea to break down your budget monthly. To get started and identify a realistic monthly budget for your business check out our small business monthly budget templates for Google Sheets.

Importance of Budgeting in a Small Business

A budget helps a small business anticipate challenges, achieve and track financial targets, and secure investment opportunities. A well-considered budget should help a small business to encounter fewer unforeseen expenses and more opportunities.

Below are some benefits of having a strong budget:

- Make Informed Decisions: A company can make more informed decisions more efficiently when they have a budget. A good budget is built on historical data and allows you to learn from your experience.

“Budgeting is a great strategy for maintaining informed control of your business. You can use data insights to plan with greater clarity and organize all of your finances in one place. This allows your leadership team to have the necessary information to drive their decision-making processes more efficiently, which is a great way for your business to act on its data,” explains Yüzbaşıoğlu. - Identify Growth Opportunities: With a budget in place, you can identify the most profitable projects for your company. Use your budget data over time to see where current resource allocation provides the most payoff.

As Yüzbaşıoğlu says, “You can use budgeting to create assumptions about your business projections by measuring the effects of different investments on your business. For example, you can make conclusions about how much revenue an investment in sales will bring in with the information gathered from your marketing efforts. By evaluating different scenarios, you can consider your options for best achieving your goals. Observing different scenarios will soon help you find which strategies work best for your business.” - Weather Leaner Business Times: All businesses should expect to encounter lean times. Having a budget in place can help you stay afloat by tracking which times are historically slow and by establishing an emergency fund. Knowing when to spend your money can be just as important as what you spend it on.

- Secure Investments: Many small businesses start or expand primarily through investments and loans. When you have a budget and a financial plan in place, you can show investors why they can put their faith in you. “Having a budget can ensure that all parties are on the same page,” says Jeff Mains, the CEO of Championship Leadership Group. “Although investors and other relevant individuals want your firm to flourish, they also need to ensure that their interests are safeguarded. It is in your best interest, then, to have a sound budget in place before you embark on any kind of company expansion, which will almost always result in additional spending.”

- Manage Risk: A well-crafted budget can help you to identify potential risks by gaining visibility into your spending. If you don’t track your money, it is easy to spend much more than you had planned (on an unsound investment).

“Looking ahead is important for risk management,” says Yüzbaşıoğlu. “Budgeting is a good way of looking ahead and contains similar methodologies as risk management. A budget allows you to look ahead and see how your activities in different areas will affect the company’s cash flow, earnings, and profitability.” - Measure Performance: Having access to current and historical financial data from your business allows you to measure financial performance year over year. Without tracking this information, you cannot know which goals you are meeting.

“Budgets are the most important tools that managers use to measure how well an organization is doing. Although budgets are commonly perceived to exist for financial purposes only, they can also be key tools to provide insight into how an organization and its departments are performing. Identifying variances — such as differences in expenses and costs and increase or decrease in sales and profits — will give a good overview to management about the performance of the company and its departments,” explains Yüzbaşıoğlu. - Set Company Goals: A budget is a great place to start goal setting. Whether you aim to spend less over time or drive more sales, a budget gives you concrete numbers on which to base your financial goals.

“When all parties are on the same page about the strategic goals of the company and the means of attaining them, it is much simpler to monitor success and work together to keep the organization on track to achieve its goals,” suggests Mains.

What Should a Small Business Budget Include?

A small business budget should include all income and expenses the business accrues over a given period. These numbers may change month to month, so it is important to either use an average, or to overestimate expenses and underestimate income.

Linn Atiyeh, the CEO and Founder of Bemana, highlights some major small business budget expenses that may not be immediately obvious. “[The expenses] need to include everything, from the employees themselves to the office spaces that they work in. They need to include technology, software, onboarding, training, client acquisition, insurance payments, marketing, product development, employee compensation, and any other anticipated costs,” she says.

The following bullets outline what to include in your budget:

- All Income and Expenses: Your budget should consider the entirety of your income and expenses. Note fixed and variable costs. It may also be beneficial to keep track of which expenses you can easily cut during lean times.

- Small Business Financial Plan: When creating your budget, consult your financial plan. If you do not have one, create an income statement and a cash flow statement.

“You must incorporate your cash flow in your projections. Cash flow refers to the total amount of money that flows into and out of a firm. If you have positive cash flow in your firm over a certain period of time, this means that more money is flowing into your business than is leaving it,” says Mains. To learn more, read our how-to guide on creating a small business financial plan. - Historical Sales Numbers: If you have them, use your historical sales numbers to project your income during the same time period in the future. If you don’t have historical data, start tracking it. As you continue to track this information, you will get a better idea of how much money your company is making and spending at different times of the year.

- Sales Forecasts: Create a sales forecast and use it to estimate your projected income. This information will help give you a target number for your budget.

- Emergency Fund: Any strong budget will include some wiggle room for emergencies and surprise expenses. Most sources recommend keeping three to six months’ worth of business expenses in an emergency fund — but remember that some money saved is better than none at all.

- Seasonal and Industry Trend Information: Most industries have slow seasons and busy seasons, and it is important to know when those times are. If you don’t have this information from your own business, a quick Google search can often tell you the answer.

- Growth Projections: Factor any expectations for major growth into your budget, such as opening a new storefront, buying new equipment, or hiring and training a new department.

How to Create a Budget for a Small Business

To create a budget for your small business, determine how much money your company spends and makes, and estimate how it will do so in the future. We’ve outlined how to create a budget in the steps below:

1. Gather Your Financial Information

This includes all income and expense information from previous years and any previous budget information you may have.

“To begin with, collect financial data, predictions, and market analysis to aid in the development of your small company's budget planning,” suggests Lattice Hudson, Business Coach and Owner of Lattice and Co. “To design your budget, consider the company's overall business and overall strategy in addition to the crucial financial data and analytics.”

2. Add Up Your Income

Use a small business budget template or spreadsheet to itemize and add up your income. Consider using a tool that tracks itemized income monthly so that you can more easily note changes over time.

3. Subtract Fixed Costs

Your fixed costs won’t change month to month, so they are the easiest to subtract from your income. Fixed costs might include rent, salaried employees, and non-variable utilities.

4. Determine and Subtract Variable Expenses

Not all costs are fixed, so you may need to do a little digging to determine some of your expenses. Calculate how much the company spent on hourly employees, variable utilities, and break room snacks and business lunches.

“Variable costs are those that change from month to month depending on your company's success, [such as] consumption-based utilities, delivery charges, transport costs, and sales commissions. When your earnings are greater, you may spend more on variable costs, but when your earnings are lower, you should aim to cut back where you can,” says Hudson.

5. Profit and Loss Statement

Prepare a profit and loss statement from the data you’ve collected. Outline how much your company made and spent in a given time period. This will be the first indicator of what your budget numbers should look like.

6. Outline a Forward-Looking Budget

Create your budget using the numbers from historical profit and loss statements. Your income and expenses may grow or shrink over time, so it is important to calculate an average or to add a buffer to your expenses. Your budget should always have money left over for incidentals, as well as allocation to an emergency fund.

Hays Bailey, the CEO and Founder of Sheqsy, recommends that you also include allocations for expansions or growth if you can see either on the horizon.

7. Review on a Schedule

Review your budget periodically. Track your income and expenses monthly, and update your budget as things change. “Over time, you will gain a better understanding of your company's operations and will be able to make more informed decisions regarding your budgeting plan,” says Hudson.

How to Create a Small Business Budget Spreadsheet in Excel

Microsoft Excel makes it easy to organize and chart your small business budget over time. The following tutorial lays out step by step how to use a template in Excel to add up your income and expenses and determine your business’s cash flow.

Gather and Organize All Relevant Financial Information for Your Business

To start your budget, you will need to gather and organize all of your financial information for the previous period. This includes income statements, expense reports, cash flow documentation, and any other relevant documents. If this is your first budget and you do not have these items, organize your bank statements, invoices, payroll information, and receipts.

By organizing your data into these documents, each month becomes easier to track than the last. The more you stay organized, the simpler it will be to maintain your budget.

Download a Small Business Budget Template

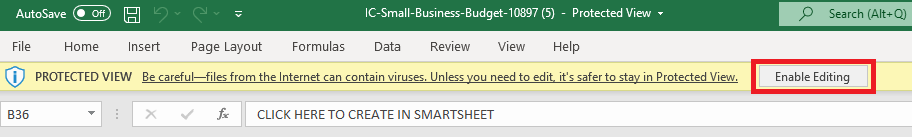

- Download the small business budget template for Microsoft Excel.

- Click the Enable Editing button.

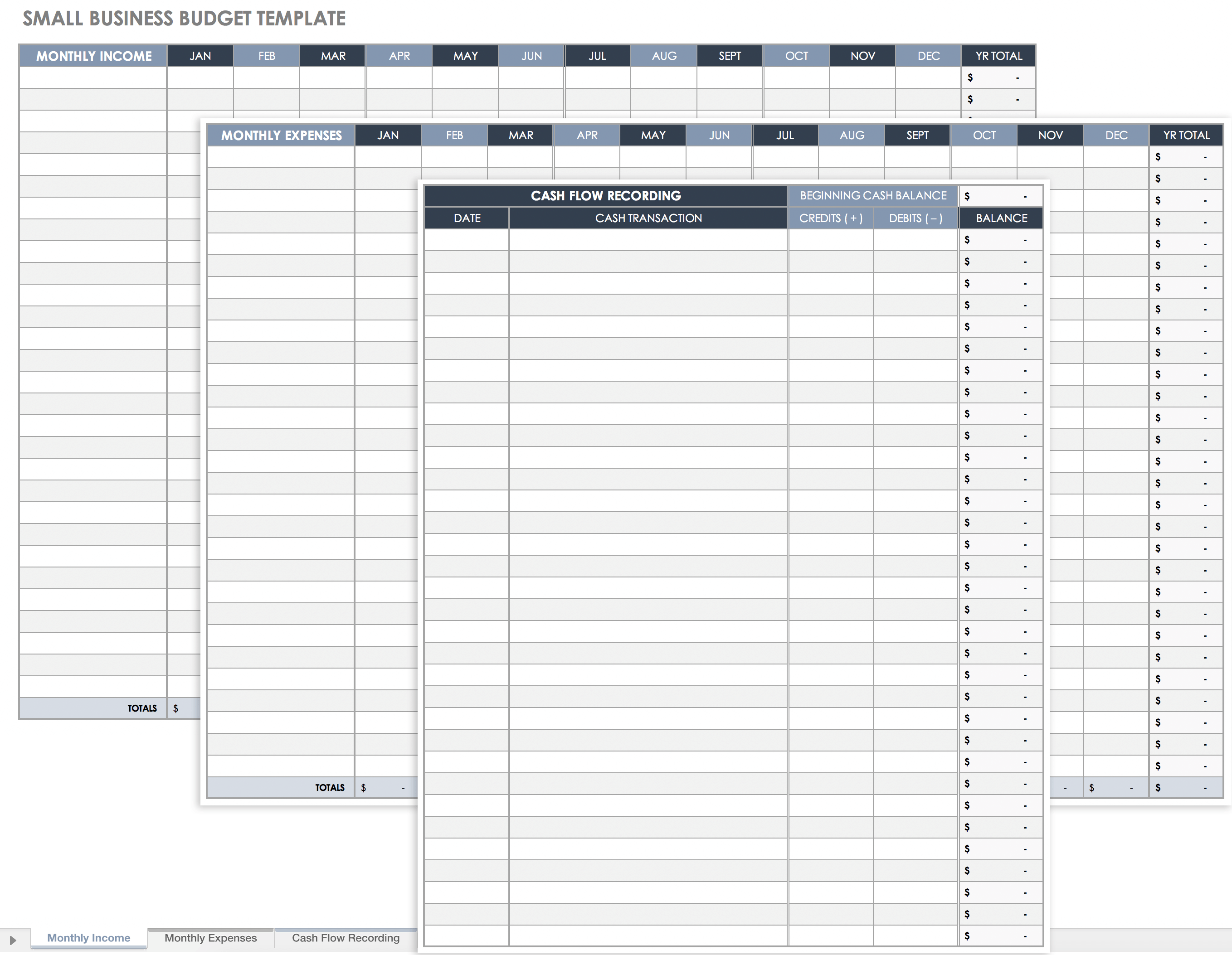

Record Your Monthly Income

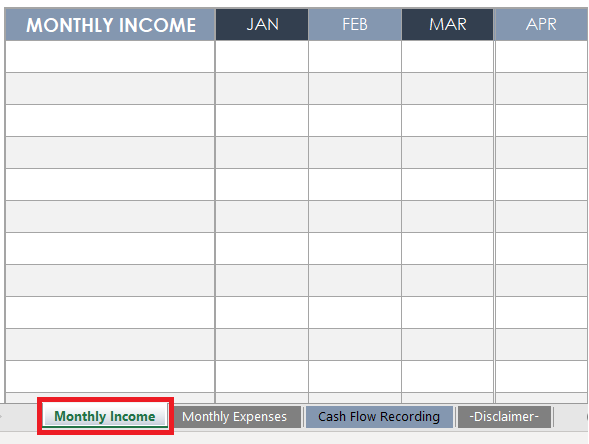

- Select the Monthly Income tab at the bottom of the document.

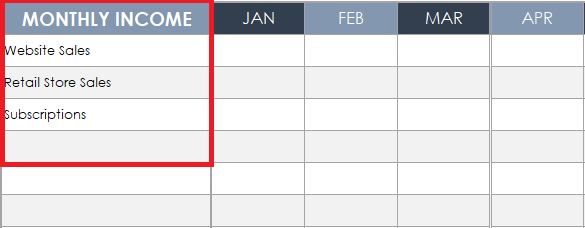

- Organize and input your income line items in the Monthly Income column.

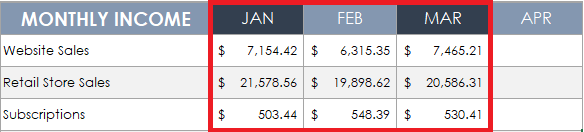

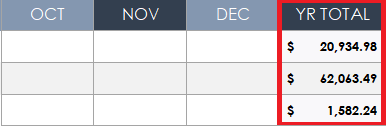

- Enter the total dollar amount for each income line item in the appropriate month’s column.

- The template will automatically add up the income numbers you entered to give you a running total for each line item, as well as a total for all line items together.

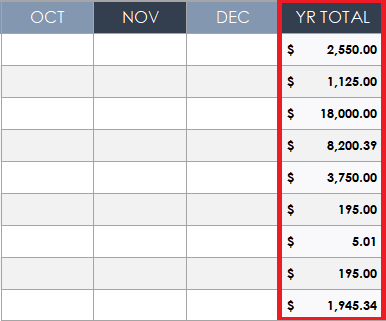

Record Your Monthly Expenses

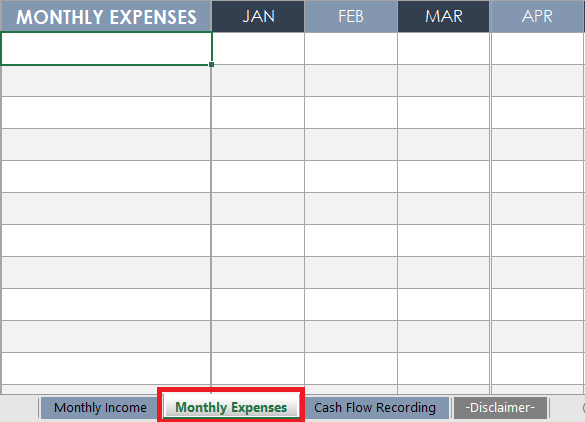

- Select the Monthly Expenses tab at the bottom of the document.

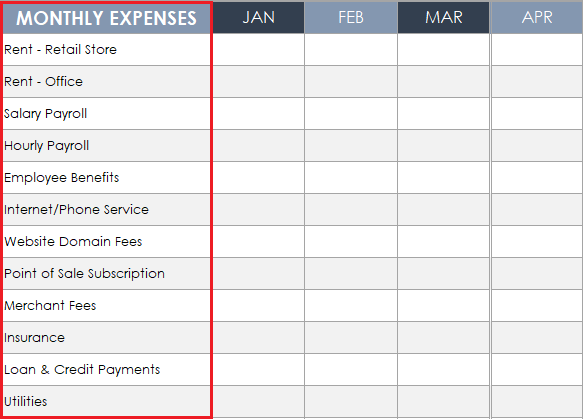

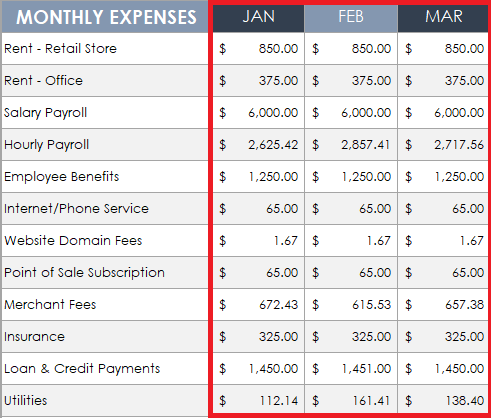

- Organize and input your expense line items in the Monthly Expenses column. Pro Tip: Use a checklist to ensure you record all of your expenses.

- Enter the total dollar amount for each expense line item in the appropriate column.

- The template will automatically add up the expense numbers you entered to give you a running total for each line item, as well as a total for all line items together.

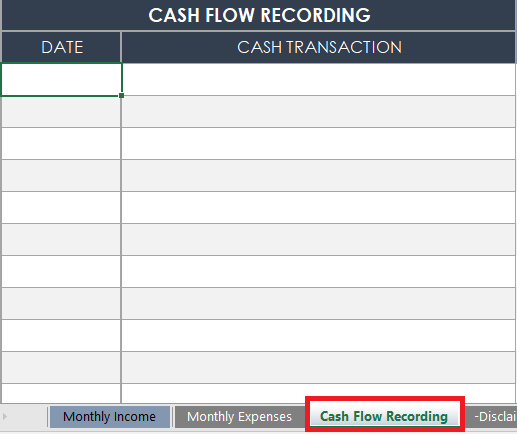

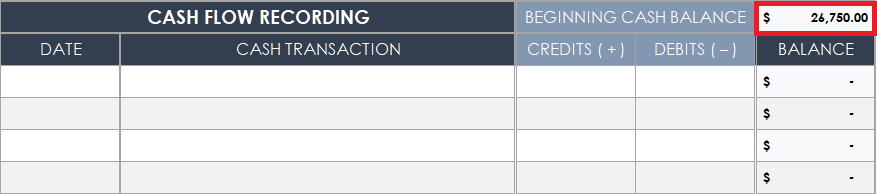

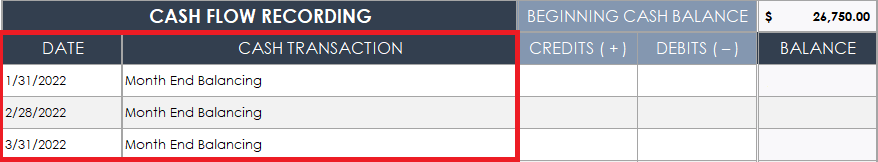

Record Your Cash Flow

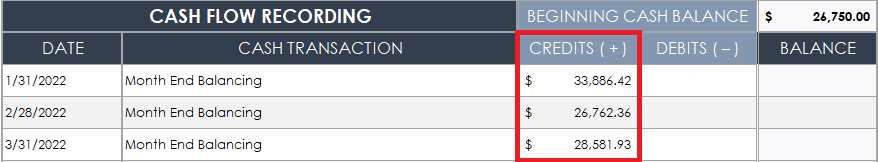

- Select the Cash Flow Recording tab at the bottom of the document.

- Enter your beginning cash balance at the top of the table.

- Input the date of your entry and a description.

- Enter your total income for the entry as a positive number in the Credits (+) column.

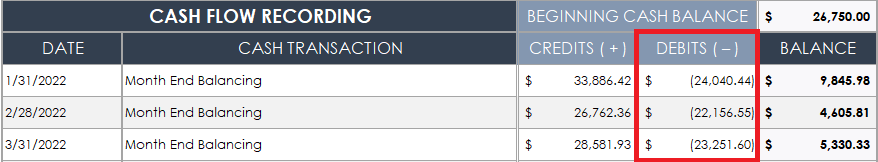

- Enter your expenses as a negative number in the Debits (-) column.

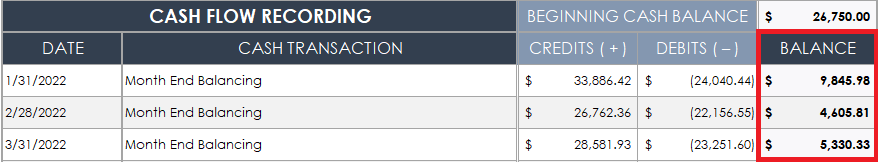

- The template will automatically add up your cash income and expenses to give you a cash flow balance for each entry.

Save and Update Your Budget Regularly

Store your budget template on an accessible drive and update it regularly. Small businesses should update their budget and cash flow as often as possible to stay up to date.

Small Business Budget Example

Download Small Business Budget Example

Microsoft Excel

| Google Sheets

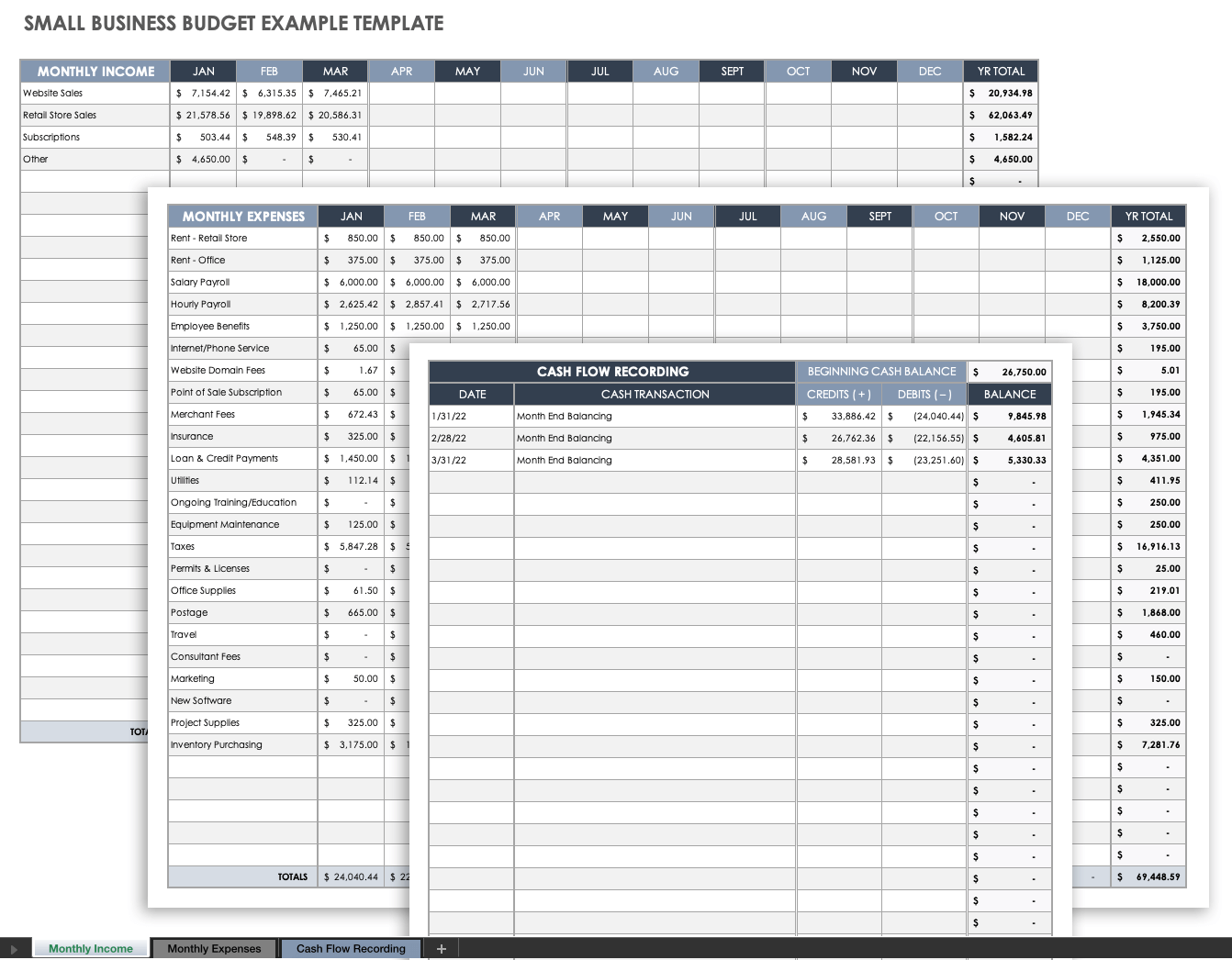

In this example of a small business budget, we’ve listed sample income, expense, and cash flow information using categories that are relevant to a small retail business. This template is fully customizable and can be used for a small business in any industry. You can also download a blank version of this template in the small business budget starter kit below.

Tips for Creating a Small Business Budget

Creating a budget for your small business can be daunting. To help you get started, we’ve gathered expert tips, from finding a mentor to setting realistic goals.

- Be Realistic: Keep all financial estimates in the realm of reality. Use historical financial data from your own past whenever possible. “My best tip is to avoid any wishful thinking or dreaming about best-case scenarios because it’s always better to use the real data from years past and to be realistic — you’ll avoid disappointment and tricky financial situations that way,” suggests Light.

- Note Changing Costs: Products and services don’t always cost the same amount every year. Be sure that the expenses listed in your budget are accurate at all times. “Be very mindful of the rapid rate at which prices can change and to get as many quotes as possible to inform your budget,” says Atiyeh. “On the first of these points, you may incorrectly assume that the amount you paid for a service in the past is still a good indicator of how much it would cost today. However, services are priced based on a multitude of factors, such as demand and market circumstances. Keep this in mind when creating a budget.”

- Find a Mentor: Doing so can cut down on the time it might take you to learn about business budgeting on your own. “Find someone who has experience in making budgets. Making a budget is technical and it requires experience if you want it to be done right. Of course, you are also allowed to do it on your own, but expect that it is going to take time and that you are in for lots of revisions,” warns Bailey.

- Overestimate Your Costs: Overestimating your costs helps ensure that your finances aren’t threatened when surprises come up or projects go over budget. You will be much better equipped to weather financial hardship if you’ve made room in your budget to respond to unexpected changes.

“If your company works on a project-by-project basis, you are well aware that every customer is unique and no two projects will be precisely the same in their outcome. It is often impossible to forecast when a project may run over budget,” says Mains. “So much of running a company is about anticipating and responding to the unexpected. For small company owners, failure to predict an expenditure or its scale may be devastating and may cause the organization to become crippled before it has had a chance to mature and develop. Company owners must overestimate their costs to protect themselves from financial risk. This is a survival strategy that will assist business owners to protect themselves against danger and failure.” - Just Do It: Budgeting can be difficult and scary, but it is so important for a business to know where its money is being spent. Sit down, get organized, and create a budget for the health of your company. “Either buy inexpensive accounting software, use an Excel spreadsheet, hire a bookkeeper, or get out a pencil and a piece of paper,” suggests Kristine Stevenson, a tax resolutions specialist and author of How to Avoid Trouble With the IRS. “It does not have to be complicated. Not sure how much income you'll make? You're going to have to estimate. Not sure how much 'stuff' will cost to buy? Get on the internet and do some research. Write it down. Income (minus) expenses equals zero for a balanced business budget.”

What Specific Types of Businesses Should Consider when Budgeting for a Small Business

Budgeting for any business involves adding up income, subtracting expenses, and identifying where to spend and save money. Because different industries require different strategies, we’ve created a list of things to consider for specific small business types.

“One thing that is unique to small businesses as a whole is that there are so many different types of businesses. This means that there is no one-size-fits-all budget plan for small businesses. Each business should tailor its budget plan to its own specific needs and circumstances,” explains Lindsey Hyland, Founder of Urban Organic Yield.

- Seasonal Businesses: Some small businesses, such as those based around holidays or gardening, operate at a much higher business volume at certain times of the year. These businesses need to consider that their busy season will bring in much more income than their slow season(s). One way to tackle this is to take an average of your monthly income for the year and use that as your monthly operating budget. Don’t project based on the biggest numbers — use the smaller numbers or an average. For these businesses, it is especially important to establish an emergency fund so that a surprise expense during the slow season doesn’t become a catastrophe.

- Recruitment and Staffing: Businesses that deal with recruitment and staffing need to have a finger on the pulse of the businesses they work with. Do outside research into the growth or downscaling of other businesses to determine budget numbers for a given period.

“Since my company is in the industrial and equipment recruiting industry, one unique challenge that we face is having to incorporate the needs of other businesses into our budget. For instance, it's important that we stay mindful of how much these businesses are upscaling or downscaling their operations at any given time, as that directly impacts the provision of our services,” says Atiyeh. - E-commerce: Online businesses may have fewer fixed costs, such as rent, but may have more variable ones. Shipping costs, shipping zones, import taxes, and shipping supplies will change based on sales volume, so find an average or inflated number that works for these budget items. Companies that operate exclusively online should also invest in a well-made, working website and have a system in place for potential returns. These two things will help improve remote customer service, which can lead to more sales — and a larger budget — in the future.

- Nonprofits: Not-for-profit businesses are funded in a variety of ways, including through grants, donations, and dues. For these businesses, it is even more important to keep the budget as realistic as possible at all times, as there is commonly less money to move around. For more information and to help keep your budget balanced, peruse our list of free nonprofit budget templates.

- Inventory Business: Remember that it can be very expensive to keep large amounts of inventory on hand. Buying more of a product to sell can sometimes be cheaper because of the economy of scale, but ensure you have the space and capacity to hold on to things that don’t sell right away. Consider that you may need to spend more on rent and temperature control for a place to store these items.

- Custom Orders: The price of a custom order is not only the cost of the finished product, but a combination of factors. Determine a cost for your time and labor for conception, execution, materials, and delivery, and factor those into your expenses.

- Startups: Budgeting for a company with no existing financial history can be tough. Company owners will need to do research on the industry and use those numbers to create a rough estimate for their budget. When you are estimating a budget from scratch, be sure to overestimate your costs to mitigate risks. It is always a good idea to ask professionals and people with experience. Visit this list of free customizable startup budget templates to get started.

- Construction: Construction companies need to factor in the cost of all associated permits and insurance on top of all of the general costs of doing business. Permits and insurances may change based on the specific job you are doing, so it is critical to factor those costs into the relevant monthly budget. To help keep you organized, check out this list of free construction budget templates.

- Service: Businesses based on service need to put a larger portion of their budget toward staff training and retention. Better employees mean better service, and much of an employee's ability comes from their training. Additionally, you do not want to lose the valuable employees you spend time and money training, so these businesses need to factor in rising pay scales for more qualified staff.

- All Small Businesses: Do not forget to factor in taxes and fees involved in running your business. If you don’t know what they are, ask a professional for help. “There are a shocking number of people that do not make any self-employment tax payments to the IRS for lack of fear or know-how,” says Stevenson.

How to Manage a Small Business Budget

Manage your small business budget by spending within your means and saving money where you can. Make sure your budget is as realistic as possible, and update and revise it on a regular basis.

- Spend Within Your Means: Whenever possible, do not spend more money than you make. Use loans and credit wisely so as not to dig yourself into a hole. “Make do with what you have, start small with the free versions of software before you upgrade. Save for equipment. Make room in the budget later if you can’t afford it now,” advises Stevenson.

- Get Multiple Quotes: When you work with other businesses, it is in your best interest to get multiple quotes. You can use these quotes to negotiate the prices of goods or services that you need to run your own business, and save money in your budget. “By getting as many quotes as possible, you can build a more accurate understanding of the true prices of what you'll need throughout the period of time that you're budgeting for. By getting quotes from several sources rather than just one or two, you can make sure that your estimates are fair and accurate,” suggests Atiyeh.

- Revisit Your Budget Regularly: Circumstances can easily change from month to month or year to year. “The best way to stay on budget is to revisit the budget regularly. Budgets shouldn’t be set and then put away, they should be consistently reassessed and adjusted. If you’re committed to tweaking and allowing your budget to evolve with a watchful eye, you’re far more likely to stay within its bounds,” says Light.

- Be Realistic from the Outset: It is easy to get carried away with lofty goals and underestimated expenses. The closer your budget reflects reality, the easier it will be to stick to the plan. “Don’t underestimate expenses just to make your budget look conservative, because a budget that’s unrealistic is so much worse than not having a budget at all. It is misleading and it can cause lots of problems in the long run,” warns Bailey.

How to Do a Small Business Budget Efficiently

There are three key ways to help ensure that you manage your small business’s budget efficiently: Use the tools that are available to you, review your financial data on a schedule, and seek help when you need it.

- Use Software Tools: There are many software tools that can help you to create a budget. Many offer free trials so that you can find the one that works best for you. You may also find that a template suits your needs.

- Hire Help: Consider using the professional services of a financial advisor, or hire an accountant to manage your budget. For many businesses, hiring someone to manage the money is an inevitability that should be considered sooner than later.

- Create a Review Schedule: Small businesses should record budgets monthly. Track and store your monthly budget data so that you can reference it for future months and make changes as needed.

Small Business Budget Starter Kit

Download Small Business Budget Starter Kit

We’ve created this small business budget starter kit to help you get started creating and maintaining a budget. We’ve included a blank budget template from the example above, plus powerful cash flow and income statement templates to help keep you organized and on track. We’ve also included a customizable budget checklist so that you can ensure you’re tracking all of the information you need, every time.

Small Business Budget Template

Download Small Business Budget Template

Microsoft Excel

| Google Sheets | Smartsheet

Use this blank small business template to calculate your income, expenses, and a simplified cash flow. This powerful template adds up your itemized income and expenses each month, giving you a running total while in progress and a yearly total once completed.

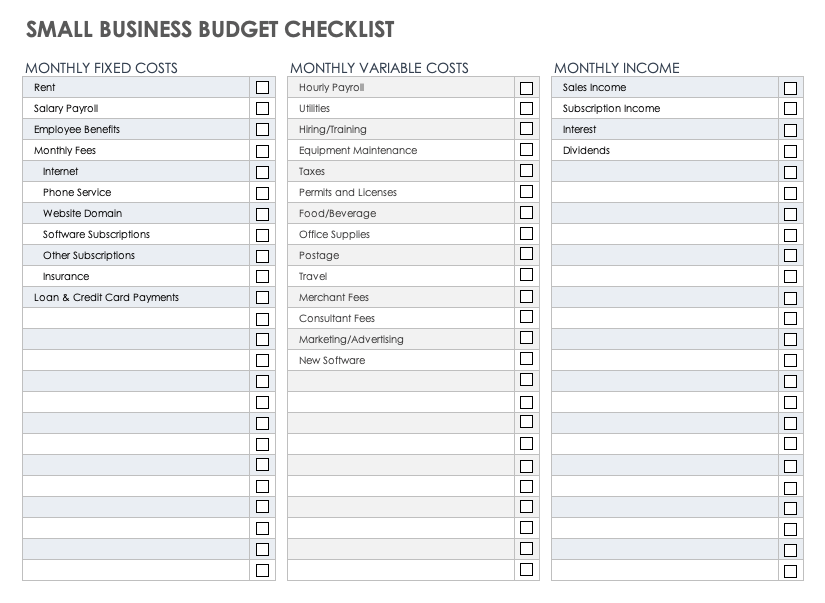

Small Business Budget Checklist

Download Small Business Budget Checklist

Microsoft Excel

|

Adobe PDF

| Google Sheets

This customizable small business budget checklist will help ensure that you’ve included all income and expenses in your monthly budget. The checklist includes a list of some of the most common business expenses, but you can edit it as needed.

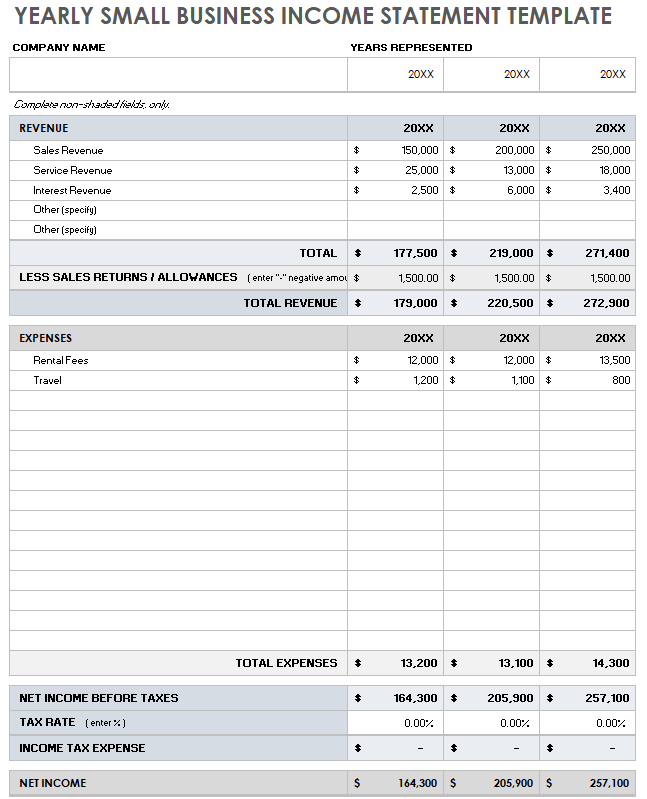

Small Business Income Statement Template

Download Small Business Income Statement Template

Microsoft Excel

| Google Sheets

Use this small business income statement template to track your company’s total income and expenses over time. Customize it to track by month, quarter, or year, and use it to complete the income and expense information on your budget template.

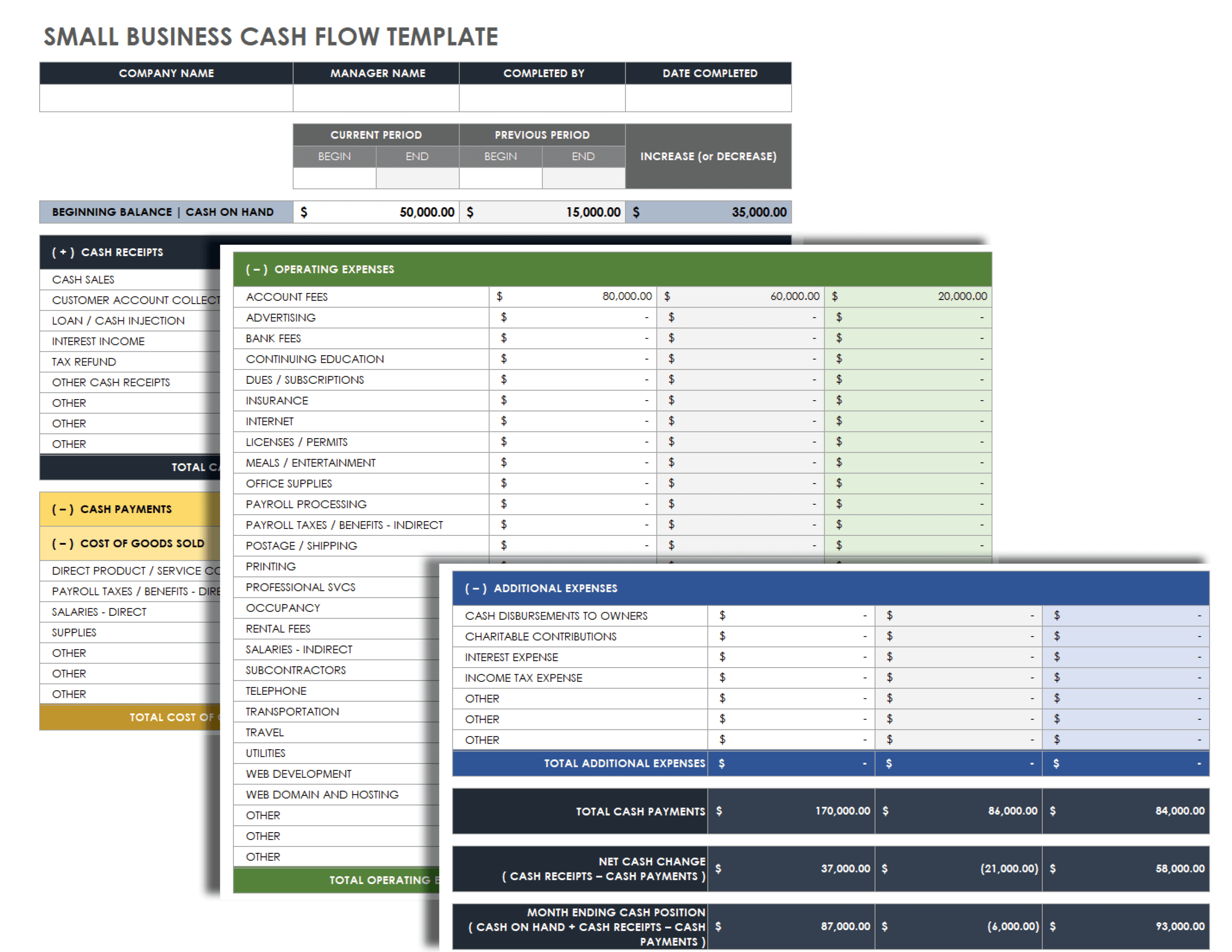

Small Business Cash Flow Statement Template

Download Small Business Cash Flow Statement Template

Microsoft Excel

| Google Sheets

Use this small business cash flow statement template to follow your cash income and expenses. Input your cash flow in the appropriate cell, and compare the current to the previous time period. The template will generate your total cash payments and ending cash position, which will help you fill in your budget template.

Streamline Small Business Budgeting Real-Time Work Management in Smartsheet

Discover a better way to connect your people, processes, and tools with one simple, easy-to-use platform that empowers your team to get more done, faster.

With Smartsheet, you can align your team on strategic initiatives, improve collaboration efforts, and automate repetitive processes, giving you the ability to make better business decisions and boost effectiveness as you scale.

When you wear a lot of hats, you need a tool that empowers you to get more done in less time. Smartsheet helps you achieve that. Try free for 30 days, today.